Investing 101: The Importance of Diversification

Though we have experienced some market volatility in recent weeks and months, it’s not all that unusual or surprising. Investing is sometimes like riding a roller coaster that you don’t have total control of. There will be ups, downs, twists and turns. Ideally, you come out the other side with a smile on your face as long as you don’t make any big mistakes along the way.

We’ve been talking recently about preparation for market volatility and having the right mindset when the market is down. Another major key to successful investing is diversification. A volatile market is proof positive that you need to diversify your investments. It can be your safety net in a bear market and your strategy for sustainable growth in a bull market.

U.S. vs. Foreign Markets

We’ve seen ebbs and flows in the United States stock market and in markets worldwide throughout 2019. Until recently, U.S. stocks were performing great while many international stocks were struggling. However, markets tend to self-correct and balance out over time. That’s why it’s a good idea to diversify with U.S. and international investments. The global equity market also presents some wonderful opportunities. You certainly want to follow the trends and time your moves accordingly when one market is hotter (or colder) than the other, but maintaining a diverse portfolio is smart investing.

Real Estate

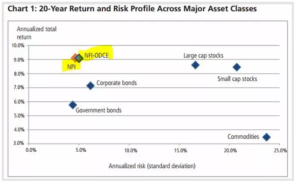

Private Core real estate (not publicly traded REITs) is many times less volatile than the stock market. This type of real estate has been one of the lowest volatility investments over the last 20 years. Adding uncorrelated assets to your portfolio (investments that don’t rise and fall at the same time as your other investments) is a proven way to increase your overall returns.

A MetLife report measured the correlation of stocks, bonds and direct, private real estate. It found that “Since 1990, the average 5-year rolling total return correlation between core real estate and large-capitalization stocks and that of US government bonds was 0.56 and 0.67, respectively,” it concludes. “Its low correlation relative to other asset classes boosts its weighting within a modern portfolio. Core real estate is a portfolio diversifier over a long-term hold period.”

Risk Management

One of the primary benefits of investment diversification is risk management, which is a central strategy you will find when you work with just about any successful financial advisor. You want to protect your money and avoid major losses while experiencing steady long-term gains. This is what risk management (or risk mitigation) is all about.

Diversification allows you to reduce your risk. We all know the saying that you “shouldn’t put all your eggs in one basket.” Well, this is exactly what that means. By spreading your eggs (your investment funds) across multiple baskets (stocks, bonds, retirement savings accounts, real estate investments and more), you are protecting yourself from significant risk. If you put all your money into one hot stock or leverage real estate investment and it suddenly flops, then you are left with nothing.

“You can’t know which of the items you are betting on will provide better results, you know that they will behave differently,” says Ray Dalio, Co-Chief Investment Officer of Bridgewater Associates, L.P. in his recent LinkedIn article. “By mixing them appropriately you can reduce risk. Diversifying well is a matter of knowing how to reduce your expected risk by more than you reduce your expected return (i.e., improving your risk-return ratio).”

Big Losses vs. Big Gains

When there are extreme market swings like we’ve experienced lately, a lot of investors think they can just make up big losses with big gains. It never quite works that easily. Smart investing is about long-term financial growth. Trying to predict the short-term roller coaster to buy that magic stock at just the right time is usually more of a recipe for disaster than success. A patient, long-term mindset coupled with diversification and risk management is the only way to truly ensure sustainable investing success in the grand scheme of things.

For help with your investment portfolio on the road to financial independence, contact Illumination Wealth today. Our experienced financial advisors can help you diversify your portfolio, reduce risk and manage your long-term wealth plan. If you want to do it right, hiring a dedicated financial advisor is the only way to go!