The Cash Balance Plan – A Major Retirement Plan for Professionals

We’re all familiar with 401(k) and Simplified Employee Pension (SEP) plans as the most common retirement plan options, then there others like SIMPLE IRAs that are popular for certain business owners. However, there is another retirement savings solution that certain business owners, self-employed individuals and 1099 contractors may want to consider. These are known as Cash Balance Plans.

Who Can Benefit from a Cash Balance Plan?

Cash Balance Plans are not available to be established by W-2 employees and they are typically not ideal for large businesses with many employees. However, small business owners and high-income professional service providers such as doctors and attorneys could see major benefits from establishing a cash balance plan. The same goes for solo practitioners and independent contractors who earn a good amount of money each year and wish to contribute as much as possible into a tax-deferred retirement account. The tax savings can really be huge with some of these cash balance plans—far outpacing the maximums allowed into a 401(k) or IRA.

How Much Can I Contribute?

How much you can contribute to a cash balance plan will depend on numerous factors including your age and how much you already have in the account. A specific law sets a limit of approximately $2.5 million that you can accumulate through a cash balance plan. The older you are and the less you have in there, the more you can contribute. Like a 401(k), you can designate a fixed dollar contribution each year or a specified percentage of your income/salary.

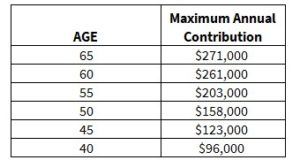

The table below illustrates the maximum annual amount you can contribute to a cash balance plan by age. These contribution amounts are above and beyond the maximum 401(k) limits as well. Why is this valuable? Because a 40-year-old in the 35% Federal tax bracket who lives in CA that can maximize the contribution would save over $37,000 in taxes and have their earnings in the account compound without the friction of taxes.

Like all investments and retirement plans, cash balance plans are not for everybody and only certain types of businesses, partnerships, sole proprietorships and independent contractors will see the most benefits from these retirement savings plans. However, when the conditions are right and you have a good investment manager working for you, they can be much more fruitful compared to traditional IRAs.

How Does a Cash Balance Plan Work?

A cash balance plan is actually a hybrid retirement plan that acts in many ways like a defined contribution plan such as a traditional 401(k) and a defined benefit plan. With a 401(k), the money that you will have in retirement (your benefit) is not “defined.” Instead, your retirement benefit depends on the performance of the investments in the account that holds the defined 401(k) contributions. You bear the risk that a market downturn will impact your 401(k) and as an employer, you have no risk in providing a fixed retirement benefit. With a cash balance plan, on the other hand, the amount of money an employee can expect in retirement is “defined.” Each year, you would make a contribution to the company’s cash balance plan based on a specific contribution formula.

A chosen investment manager would then invest the money on your behalf or you could invest the funds yourself. At the end of the year, the account would be credited with a certain interest rate based on projected earnings. If the investment earnings exceed the set rate, then the excess money will be rolled into future investment years as part of a reserve account. It’s important to know that the account is not technically yours as an individual like a 401(k). It is a company contribution that funds the account and only one pooled account exists. However, each eligible participant would have their own share of the account based on a crediting formula. When an employee terminates their relationship with the company or retires, they can roll over their vested balance in the cash balance plan to an IRA.

If the earnings of the investments are less than projected, the company may have to make a larger contribution the next year. If the reserve account gets too large, then the company can always amend the plan to make additional credits to the individual accounts within the plan. What’s great is that the company is taking the bulk of the investment risk, not the individuals.

Which Retirement Plan is Best for Me and My Business?

To learn more about cash balance plans or to discuss your retirement savings plan options (as an individual or as a business owner/manager) with a leading financial advisor, contact Illumination Wealth today for a consultation.