Tax Changes for 2017

Retirement Contribution Limits

Every year the IRS makes adjustments to retirement contribution limitations for inflation. For 2017, most savings contribution limits remained the same with the exception of the SEP/401(k) and individual HSA limits. The maximum SEP / 401(k) contributions went up from $53,000 to $54,000 (plus $6,000 for those age 50 and older). The individual HSA contribution limit went from $3,350 to $3,400 (plus $1,000 for those age 55 and older). Below are the contribution limits for 2017.

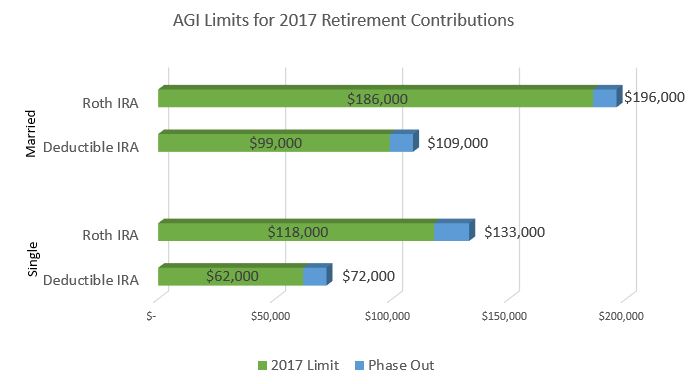

Traditional IRA contributions are limited based on income if you also participate in an employer-sponsored retirement plan. Roth IRA contributions are limited based on income regardless of your participation in an employer-sponsored retirement plan. These income limitations as well as the phase out are as follows:

Other changes for 2017

| Standard Deduction: | Single: $6,350 (up from $6,300) Married: $12,700 (up from $12,600) This is a small increase to the standard deduction which will reduce the tax owed for those who do not itemize deductions. |

| Medical expense deduction: | Above 10% of AGI for all taxpayers (previously 7.5% for those 65 and older) Seniors will have the same hurdle as younger taxpayers to claim an itemized deduction for medical expenses. |

| Social Security wage base: | $127,200 (up from $118,500) This large increase in the Social Security wage base means that individuals who reach the max on Social Security taxes will owe an additional $539 this year. |

| Estate tax exemption: | $5.49M (up from $5.45M) For those with taxable estates, the exemption goes up slightly. |