Net Worth: One Number to Monitor your Finances

Are you overwhelmed by all the different numbers you have to think about when it comes to your personal finances? How much do you need to save? How much should you contribute to your 401k? Is your credit score good enough? Are you on budget? What are your investment returns? There are many numbers you can be thinking about, but if personal finance seems overwhelming to you, then start with the one number that matters most — your net worth.

What is net worth?

Your net worth is the value of all your assets minus the value of all your debts — what you own less what you owe. It’s a single number that tells you what you’re worth (financially). It takes into consideration your cash savings, retirement savings, investments, personal property like cars, your home, and anything else that you own of value. It also considers your debts — credit cards, car loan, mortgage, student loans, and other loans. It’s a comprehensive picture of where you are right now.

Why do you need to know it?

Most people want to grow their net worth to support themselves in retirement, to give to charitable organizations, or to pass on wealth to their beneficiaries. Tracking your net worth over time helps you to see, in one number, whether you are making progress toward these goals. As you make financial decisions, you can evaluate them in terms of the impact on your net worth. Will making this decision help me grow my net worth?

For example, if you are considering buying a car, the car is an asset that is initially part of your net worth. But over time the car will depreciate and reduce your net worth. Buying a car will likely not help you to grow your net worth.

If you are considering making an investment, and you have plans to keep the investment for many years, then the investment may increase in value. Making an investment may help you to grow your net worth.

The aim of most good financial decisions is to grow your net worth. So if you evaluate your decisions based on the impact on your net worth, you will be more likely to make good financial decisions.

What is your net worth?

You can calculate your net worth right now by adding the value of all of your assets (things you own) and subtracting the value of all of your debts (things you owe). You can do this with pen and paper, a spreadsheet, or a personal finance application.

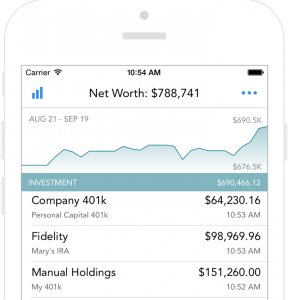

Personal Capital is a useful application for calculating your net worth. When you link your online financial accounts, the application will get the value of each account and calculate your net worth. If you have an asset or debt that does not have an online account (like your car), you can add that in manually. If you enter your home address, Personal Capital will use an estimate from Zillow for the value of your home. Once you have set up your accounts, Personal Capital will start tracking your net worth over time and display it in a graph so you can watch as it changes.

Start tracking your net worth

Now that you have a single number you can track to know how you’re doing financially, you have no excuse not to learn this number. If you start tracking your net worth over time, and you’re doing the right things financially, you’ll see your net worth increasing. That will give you the positive reinforcement to continue making those good financial decisions and set you up for financial independence.