The Mindset of a Successful Investor in a Difficult Environment

By: Andrew Costello, CFP®

Nobody invests money in the stock market to lose money— they invest to get paid for taking a risk with that money. Unfortunately, most individuals who invest in the stock market typically end up with a significantly lower return than what the stock market returns over time, and in some cases, lose money.

Why? Because we are human, and emotion enters the equation and causes us to make irrational decisions.

“The most important quality for an investor is temperament, not intellect. You need a temperament that neither derives great pleasure from being with the crowd or against the crowd.” – Warren Buffett, Chairman and CEO of Berkshire Hathaway

“The two greatest enemies of the equity fund investor are expenses and emotions.” – John C. Bogle, Founder and Retired CEO of The Vanguard Group

Warren Buffet and John Bogle are both successful investors and have the right mindset in tough market environments. They understand the benefit that is derived from keeping your emotions and investment decisions separate.

What types of emotion are they referring to?

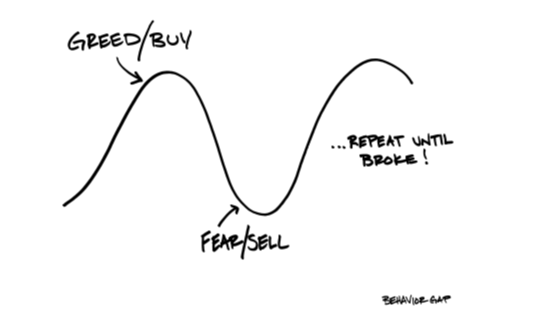

Fear and Greed. These two emotions are primarily dominant, but they take form in more ways than we can imagine. Simply put, greed causes us to buy when we shouldn’t, and fear causes us to sell when we shouldn’t.

A perfect example of greed is during the dot com bubble when many investors were putting their money into ‘hot’ tech stocks after they already had huge gains. My mother was a Representative at a Financial Service company and she knew something seemed off when everyone was coming in to her office to invest their life savings into technology stocks. She tried her best to talk them about it but was met with stark resistance. The very notion of getting rich quick in a short amount of time sounds good, right? Well, it was too good to be true as we know what happened next.

An example of Fear is during the great recession in 2008/2009. When the stock market took a nose dive, people jumped ship and sold their investments and went to cash near the market bottom. Some stayed in cash. Unfortunately, they missed out on the tremendous recovery. It’s easy to get scared during market selloffs. And that fear is only amplified by the headlines.

Do you know what’s even more frightening? Being invested in 100% stocks and not knowing you didn’t have the appetite to take on that much risk.

However, there is a way to break the cycle before breaking the bank and your confidence. We’ve all had different experiences with money which alters our perceptions and behaviors. The good news is that you get to choose how you want to handle your money going forward.

So, how are you supposed to overcome emotion when the market runs off the rails?

1. Being properly diversified in the first place. This essentially means understanding your risk tolerance and time horizon, and then investing your money in the appropriate mix of stocks, bonds, real estate and cash. You should be diversified among asset classes and within asset classes. If done correctly, you have now established guard rails for your portfolio and financial life. The economy and market can run off the rails all it wants, but you know your net worth will stay on track.

2. Make a plan. And stick to it. Identify your financial goals by putting a name to them. Follow that up with a total dollar amount, investment strategy, and how much you need to save each month to get you there. It’s all about small wins. Create milestones to celebrate along the journey, and you will enjoy the process.

3. Understand what goes up, comes back down. And then goes back up again—you get the idea. Financial markets are cyclical. Business is cyclical. Don’t get caught in the present, thinking you must do something or else your plan will fail. Your plan should already account for market declines! Remember to think long term. The stock market is like walking upstairs with a yo-yo. There will be bad markets and recessions, but over time, the market has appreciated and will continue to do so.

4. Talk to someone. Research shows that having someone hold you accountable to the plan you agreed to will help you stick to the plan. For some, an Advisor or Financial Planner will often serve as the voice of reason. For others, talking to someone you trust will call you out for not keeping your word is also very powerful. The goal is to get out of your head and remember what you agreed to doing in the first place.

5. Stop looking at your accounts. This sounds like bad advice but hear me out. I can give you a rough idea of how much I have in my investment accounts, but I couldn’t tell you exact numbers. Why? Because I don’t need the money for 40 years, so the balance is irrelevant to me. But I know it’s invested properly and getting automatically rebalanced. If someone is managing your money, make sure you understand the costs of investing and their management fee. But looking at your account balance everyday may create unnecessary stress.

6. Ignore the headlines. Something always causes a drop or rise in the US stock market, but it’s never what the reporters attribute it to. Let me frame it this way: a world event doesn’t make stock prices go lower. The event is what we point at, but what causes the decline is investors or institutions selling shares! Why are we selling? Because someone put a name to the sell off and it’s in our DNA to move with the herd.

7. Be positive. Easier said than done, I know. The truth is… you will never feel “good” in a bear market. But you can re-train your way of thinking to understand that an opportunity has presented itself. When equity prices decline, it means stock is trading lower than you may have purchased it in the past. That sounds like a good buying or rebalancing opportunity to me.

What is the right mindset of a successful investor in a difficult environment? What do Warren Buffett and John Bogle know that we don’t?

The right mindset is one of emotional stability, consistency, opportunism, discipline and long-term orientation. You can have that mindset through a culmination of being invested properly at the onset, having a plan, and being held accountable to that plan.