Financial Planning in Late 2016 and Early 2017

The world is entering a new era of financial planning and wealth management. Funds are beginning to change hands from the Baby Boomers to the younger generations. In the midst of this transitional time, the financial industry is also feeling the impacts of the Digital Revolution. There is more information at the fingertips of investors and consumers than ever before. However, navigating the mounds of information can be overwhelming and advisors still play a key role in financial planning.

In an ever-changing global landscape, understanding the health of the economic world is more important than ever. Here are some key factors to consider when planning for late 2016 and early 2017.

1. California and Texas Are Growing

Wealth is continuing to grow in California and Texas. According to David Wilson, “These markets are all benefiting from robust economic growth, low unemployment, and strong performing asset classes such as real estate.” His research showed that when looking at investors who have at least $1 million to spend, half of them are located in California and Texas.

In another survey reported by smartasset.com, cities in Texas took 5 of the top 25 cities for stable growth during 2016. We have relationships that provide opportunities for individuals looking to invest in these states.

2. Financial Literacy is Easier in the Digital Revolution

More investors have a desire to understand where their funds are going and have more control over what they are investing in. Luckily, as the digital age continues to develop, this financial information is easier to obtain. While it is wise for consumers to become more financially literate, the amount of information available can make it difficult to follow a successful investment path.

The best choice for consumers is to familiarize themselves with the industries they invest in and have a trusted financial advisor to answer questions and make recommendations. Many financial advisors will provide resources that allow their clients to play a bigger role in their financial future. Consumers should know and understand where their hard earned investment dollars are going.

3. Personalization is Important

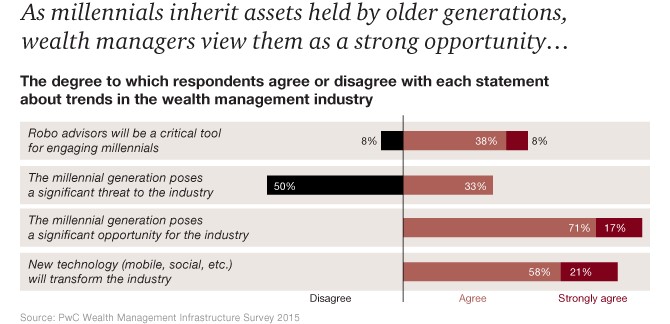

Technology is growing and expanding in the financial world. We are now seeing the need for more personalization and a VIP atmosphere. As the Baby Boomer’s funds transition into the hands of the Millennials, financial advisors are seeing the opportunity and the challenges that this generation will bring.

The end of 2016 and beginning of 2017 will continue to see the addition of new technology into the industry, but there will also be a transition of more personalized service by financial advisors. The Millennial generation demands a higher level of customized service and the financial industry must adapt to this market preference.

As seen above, a 2015 survey by PwC’s Wealth Management Group, showed that 79% of wealth managers polled stated that they agree with the fact that new technology is going to transform the industry. This new technology is necessary to personalize services to the younger generations.

4. The U.S. is Seeing a Luxury Slow Down as Global Housing Markets Grow

The luxury housing market has slowed in the United States. So far, 2016 has seen the lowest amount of luxury home sales since 2010. However, the real estate market worldwide is still growing. Housing markets in the U.S. are continuing to see slight increases and markets in foreign countries are building momentum.

While there is evidence that foreign markets are still growing, some argue there is a bubble already bursting. Tony Sagami of Mauldin Economics states, “The average price in the 100 largest Chinese cities has jumped to a record 3,100 yuan (US$463) per sq. m. That is an unbelievable 50% increase in the last 12 months!”

5. Investments in 3rd World Financial Markets Will Increase

2016 has seen growth in regions that had a significant slowdown over the last few years. Research from a recent Business Insider article states that while emerging markets are not at the same levels of growth that they were in previous years, they are stabilizing, which has prompted more and more investment.

As markets are stabilizing in some countries, there are threats around the globe that are keeping industries from seeing steady growth. The same Business Insider article shares that, “The International Monetary Fund has cut its global growth expectations for 2016, down from 3.4% to 3.2%, and looking around the world it isn’t hard to see why.”

As we peer into 2017, financial literacy and technology are the hot trends for investors to monitor. When working with your financial advisor, it is important that clients have open communication about their questions and goals so they can take an active role in their financial future.

Author Bio: Evan Harris is the founder and owner of SD Equity Partners. Having spent the last seven years growing SD Equity Partners, Evan has become an expert in real estate finance and property investments.