Tax Saving Opportunities Are Still Available

Tax season for most people is winding down, but there is still time to lower your taxes by making a retirement plan contribution. The normal deadline has even been extended due to public holidays. If you have already made your retirement plan contributions for 2015, start thinking about 2016 tax planning. Matt talks about ongoing tax planning you can do in the video segments below.

In this edition of our newsletter:

- Retirement Plan Contribution Deadlines

- Matt Rinkey Appearances

- Illumination’s Core Values

- Q1 2016 Market Scoreboard: Our Insights

Retirement Plan Contribution Deadlines

As tax season comes to a close for most people, we want to remind you that there’s still time to make an IRA contribution for the 2015 tax year.

Traditional IRA, Roth IRA, HSA and ESA

While the normal deadline for making prior year IRA contributions (traditional, Roth, and ESA) is April 15th, the deadline is extended this year to April 18, 2016 because of the Emancipation Day holiday. And if you live in Maine or Massachusetts, you get until April 19, 2016 to contribute due to the observance of Patriots’ Day in those states. You can also make a 2015 contribution to an HSA by these same dates. You must have been covered by a High Deductible Health Plan (HDHP) during 2015 to make the HSA contribution for 2015.

SEP IRA and SIMPLE IRA

The deadline for funding the employer contribution to SEP IRA’s and SIMPLE IRA’s for 2015 tax year contributions is the extended due date of the employer’s tax return. Employee contributions to SEP IRA’s are still due by the dates listed above for IRA’s.

Qualified Retirement Plans

The deadline for making 2015 contributions to qualified retirement plans like a 401(k) is the extended due date of the employer’s return. Plans that are maintained on a calendar-year basis must have been established by December 31, 2015 to accept 2015 contributions.

Matt Rinkey Appearances

The Best Time of Year to Start Planning Your Taxes

Matt joins Craig Sewing on The American Dream Show on March 15, 2016 to discuss how the markets have recovered from a volatile state. They are joined by tax planning attorney Charles Williams to discuss how get the most out of your tax planning.

Matt Joins Jared Kelley on Rise Up Radio – March 18, 2016

Matt’s guest appearance on Rise Up Radio on March 18, 2016 discussing legacy, community, and the importance of integrating personal goals with your finances.

[soundcloud url=”https://api.soundcloud.com/tracks/252868183″ params=”auto_play=false&hide_related=false&show_comments=true&show_user=true&show_reposts=false&visual=true” width=”100%” height=”450″ iframe=”true” /]

Tax Strategies That Can Save You Money

Are you paying too much in taxes? Watch as Matt joins Kyle and Jason on Whissel Wednesdays on AM 1170, “The Answer” to discuss various strategies to save you money on your property taxes and income taxes.

Illumination’s Core Values

At Illumination Wealth, we work under a set of core values that drive every decision we make about how we serve our clients. We believe it is important that we share these core values with you, and you will be learning about a core value of ours each month.

Be Intentional

Intentional, as defined by the Merriam-Webster dictionary means: “Done in a way that is planned or intended.” We believe that life is meant to be lived with intention, not by accident. It is impossible to live your best financial life simply going through the motions. John Maxwell, leadership expert, has said that: “Intentional people fill their own calendar. They don’t allow others to fill their calendar.” We couldn’t agree more. Intentional people also spend and save their money in a way that is in alignment with their goals and values. Living intentionally is about being proactive in all areas of your life in an effort to make the biggest impact you can with what you have.

To be intentional in your financial life requires clarity around your values and priorities. To be intentional requires having clear goals. To be intentional requires knowing what needs to be done to accomplish your goals. To be intentional requires you to create the time, systems, structures, and accountability to live your best financial life.

Everything we do at Illumination Wealth is intended to empower you to live your one best financial life.

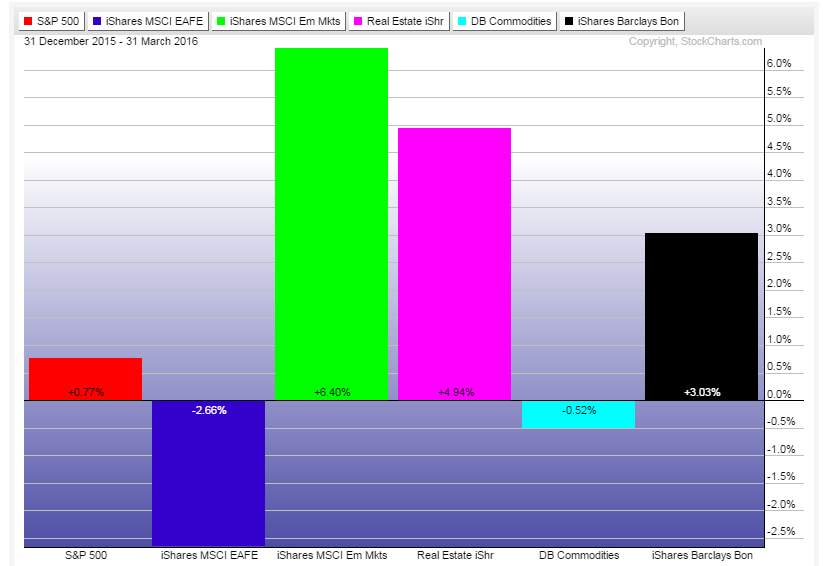

Q1 2016 Market Scoreboard: Our Insights

Being in the stock market during the first quarter of 2016 was like being on a roller coaster – you started out at the top of the first hill, took a steep dive down the tracks, and shot back up the next hill. The stock market experienced an 11% decline followed by a 13% increase resulting in less than a 1% overall increase during the quarter. Just like on a rollercoaster that you haven’t ridden before, we couldn’t tell you what comes next.

While the U.S. stock market was up less than 1% during the quarter, Emerging Markets Equities, Real Estate, and Bonds performed better. This variance highlights the importance of having a diversified portfolio.

There are some positive highlights in the U.S. economy which suggest that an imminent recession is unlikely:

- Employment growth is close to the best since the 1990s, with an average monthly gain of 234,000 during the past year. Full-time employment is soaring.

- New housing sales, starts and permits remain near an 8 year high.

- The core inflation rate ticked up above 2% and to the highest rate since 2008.

However, there continues to be uncertainty around interest rates which adds to the volatility of the market. We recommend you stick to your investment plan, and if you don’t have a plan, get in touch with us.

You can achieve anything you want in life if you have the courage to dream it, the intelligence to make a realistic plan, and the will to see that plan through to the end. – Sidney A. Friedman

As always, we hope you have found this edition to be enlightening and look forward to hearing from you soon!

All the best,

The Illumination Wealth Team

The opinions and forecasts expressed are those of Matt Rinkey, President of Illumination Wealth Management (IWM) and may not actually come to pass. Mr. Rinkey’s opinions and viewpoints regarding the future of the markets should not be construed as recommendations of any specific security or Illumination Wealth services. No part of this material is intended as an investment recommendation. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any of IWM’s services. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that investment objectives outlined will actually come to pass. Investors should consult an Investment Professional before investing in any investment program. Neither Mr. Rinkey or Illumination Wealth nor any of their employees shall have any liability for any loss sustained by anyone who has relied on the information contained herein. Entities including, but not limited to IWM, its officers, directors, employees, customers and affiliates may have a position, long or short, in the securities referred to herein, and/or other related securities, and may increase or decrease such position or take a contra position. The analysis contained is based on both technical and fundamental research. Although the information contain is derived from sources which are believed to be reliable, they cannot be guaranteed. Past performance is never a guarantee of future results.