How to Live 2017 by Design Rather Than by Default

Happy New Year to all of our clients and readers! Many of us begin a new year thinking about resolutions. New Year’s resolutions are about taking action. They’re about moving you closer to your goal. They’re about being a better you. In the spirit of taking action, we offer some articles and advice about what you can do in the new year to take action in an effort to live your best financial life.

In this edition of our newsletter:

- Don’t Default on Your Financial Decisions

- The Key to Strategic Financial Life Planning

- 3 Actions You Can Take to Improve Your Financial Life in 2017

- Market Performance

Don’t Default on Your Financial Decisions

When it comes to selecting an option, a default option that is already selected for you can make your life a little easier. The default is what you get if you do nothing, if you don’t make a decision to change it. It’s sometimes seen as a recommendation of what you should choose or what most people would choose. Most people do not achieve financial freedom. Most people are not living their best financial life.

The Key to Strategic Financial Life Planning

2017 brings a new start to the year. Your mission should be to find ways to integrate your personal life and professional life to ensure that you are living your best financial life. Instead of focusing on the tactical changes, spend time identifying the strategic actions you can take that will make a huge difference for you this year.

In the video below, Matt shares some strategic financial life planning examples that you can consider but the profound impact will be going through that exercise for yourself.

3 Actions You Can Take to Improve Your Financial Life in 2017

Are you wondering what you can be doing in January to set yourself up financially this year? We’ve come up with three things you should be doing now.

Market Scoreboard

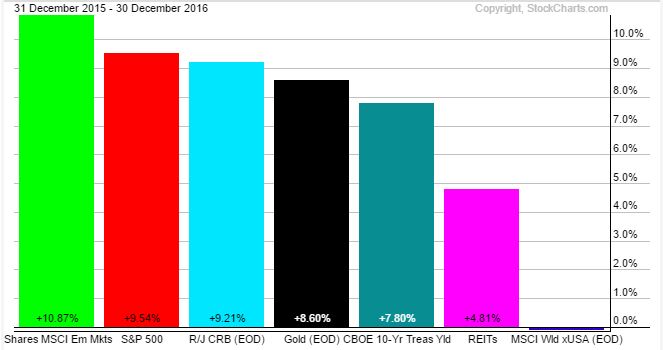

Who would have thought at the beginning of 2016 that the U.S. stock market was going to produce over 9% returns for the year. Even with the dips of a market correction, the Brexit vote, and concerns over the election, the U.S. stock market returned 9.5% in 2016.

International markets as a whole were essentially flat, but the emerging market sector returned over 10% in 2016. Commodities, gold, and REIT’s also produced respectable returns. If you got scared and pulled your money out of the market during the correction, you missed out on a profitable year in the market. Investing is maintaining your investment plan through all market cycles. If you don’t have a plan, then you are not investing.

You cant score unless you have goals. – Lewis Howes

As always, we hope you have found this edition to be enlightening and look forward to hearing from you soon!

All the best,

The Illumination Wealth Team

The opinions and forecasts expressed are those of Matt Rinkey, President of Illumination Wealth Management (IWM) and may not actually come to pass. Mr. Rinkey’s opinions and viewpoints regarding the future of the markets should not be construed as recommendations of any specific security or Illumination Wealth services. No part of this material is intended as an investment recommendation. Neither the information nor any opinion expressed constitutes a solicitation to purchase or sell securities or any of IWM’s services. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that investment objectives outlined will actually come to pass. Investors should consult an Investment Professional before investing in any investment program. Neither Mr. Rinkey or Illumination Wealth nor any of their employees shall have any liability for any loss sustained by anyone who has relied on the information contained herein. Entities including, but not limited to IWM, its officers, directors, employees, customers and affiliates may have a position, long or short, in the securities referred to herein, and/or other related securities, and may increase or decrease such position or take a contra position. The analysis contained is based on both technical and fundamental research. Although the information contain is derived from sources which are believed to be reliable, they cannot be guaranteed. Past performance is never a guarantee of future results.