Understanding Your Health Insurance Plan Options

By Andrew Costello

Did you know that the typical employed American family of four can expect to spend more than $28,000 on healthcare in 2018, according to the annual Milliman Medical Index report? Considering the financial significance of your health, it’s critical you take your health insurance decision seriously as open enrollment nears.

We understand you have a variety of options when it comes to healthcare coverage, so we wanted to provide you with information to help you consider those options. Whether you are financially independent, an employer or an employee, we believe it’s important you understand the difference between your health care options, the total costs, and how to tailor this information to your unique situation.

***Open enrollment runs from Thursday, November 1st to Saturday, December 15th, unless you qualify for a Special Enrollment Period.

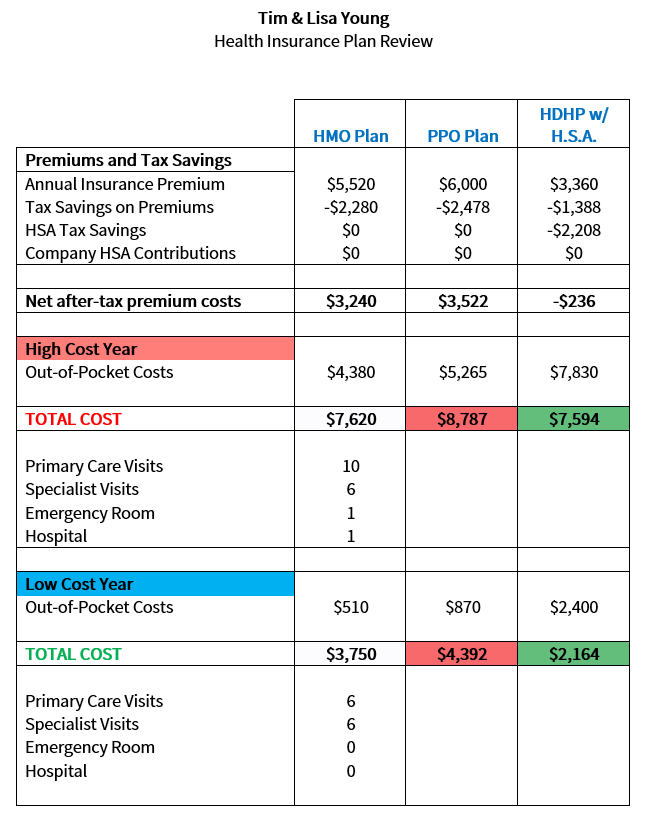

1. Get acquainted with your health insurance plan options. We have created a chart to illustrate the differences between the three most popular plan types that we see offered to our clients:

2. Understand the total costs and potential tax savings. Due to the rising cost of medical expenses and health insurance, employers have begun passing some of the premium costs on to their employees.

In addition to premium costs, there are a few other costs and tax savings you will want to keep in mind as you review your options: deductibles, out-of-pocket maximums, prescriptions and Health Savings Account contributions.

The plan listed in the chart above (HDHP) stands for High Deductible Health Plan, which begins to make sense why the plan’s premium cost is the lowest. More out of pocket expenses for you = less expense for the insurance company.

Most plans will make you pay 100% out of pocket until you reach your deductible, then it will be a percentage (coinsurance) or flat dollar amount (copayment) for service provided beyond that until you hit your out-of-pocket maximum. Once you reach that maximum, insurance will fully cover any medical expenses beyond that.

How are prescriptions treated under a High Deductible Health Plan? You will be responsible for paying the total amount that your insurance company has negotiated until you reach your deductible. This, unfortunately, may be sticker shock if the medicine you were prescribed is expensive.

How do I save money on taxes for medical expenses? There are a few instances where tax savings comes into play. If you are working for a company, you might be paying for the premiums with pre-tax dollars through a direct payroll deduction. If you are self-employed, you can deduct health insurance premiums directly on Form 1040 which is essentially an adjustment to your Gross Income.

If you are not paying for insurance premiums pre-tax through your employer as a payroll deduction, then you might be paying for a policy through your state’s marketplace. In that case, the premium costs (plus other medical and dental-related expenses) will need to exceed a certain percentage of your Adjusted Gross Income.

Another way to save on taxes for medical expenses is by using one of our favorite accounts here at Illumination: The Health Savings Account (H.S.A.). This account is quadruple triple tax-advantaged if you are an employee (triple for everyone else) By that, we mean you make contributions to it with pre-tax dollars, if you pay via payroll deduction the contributions are FICA tax free saving you 7.65%, the account can be invested and grow tax-deferred, and when you need to pay for “Qualified Medical Expenses”, the money gets distributed tax-free. It sounds too good to be true right?

Well, there’s a catch? You must be enrolled in a Qualified High Deductible Health Plan to be able to make contributions. And not all HDHP plans are eligible for H.S.A.’s. In order to be H.S.A. qualified, a HDHP must not offer any benefits beyond preventive care before meeting the annual deductible and no co-pays.

The annual H.S.A. contribution limit is $3,450 if you’re single and $6,900 for those qualified under family plans. You can add an extra $1,000 to the account if your 55 and older. Keep in mind that any contribution your employer makes to your H.S.A. on your behalf, reduces the amount that you can contribute.

3. Take note of what’s important to you and your family. Do you have a family that you need to cover or is it just you? Do you visit your doctor regularly or annual check-ups only? Are you in good health? Do you participate in any ‘risky’ activities? Are you currently being prescribed medicine? Is that medicine expensive without insurance? Do you have a family doctor that you prefer? Would that Doctor be “out-of-network” if you chose one insurance coverage over another? Would you prefer to find your own specialist or be referred to one? Does it bother you to have a primary care physician as a gatekeeper?

These are important questions in determining what’s truly right for you. You don’t want to choose a plan with a low premium and high deductible just because it’s less expensive, only for something tragic to happen that requires you to pay out-of-pocket. Case in point, my dog dislocated my knee last year when I had a High Deductible Health Plan. Between the ambulance ride, emergency room visit, MRIs, doctor visits, and physical therapy, I had to fork over $6,000 out-of-pocket (in my case, fortunately I had an H.S.A. that covered EVERYTHING). Insurance didn’t pay for a single expense because I did not meet my deductible of $6,300.

Consider the following hypothetical example of a family of three, expecting another child this year. This couple is in the 32% Federal, 9.3% State tax bracket, can make a full $6,900 contribution to a H.S.A., and has their premiums deducted from payroll. Notice that the HDHP is the least expensive option in both the high cost and low cost years. Sure, there may be more out of pocket costs until Insurance starts paying, but the higher insurance premiums on the other two plans make them a more expensive alternative from a total cost standpoint. This doesn’t always happen but when it does, it’s a “heads I win, and tails I win” scenario.

4. Tying it all together: How can Illumination assist? This decision will have a considerable financial impact on your family both today and for your future. It’s a decision that we believe should not be taken lightly but it can be time consuming when it comes to analyzing your choices. However, it is important because the stakes are high.

We understand quality coverage comes at a cost, and we are sensitive to ensuring that you and your family are adequately insured. We also know firsthand that comparing plans and choosing one can be a complex challenge. We have reviewed hundreds of health insurance plans over the years and know exactly what we’re looking for and how it impacts your overall budget. As much as we advocate for Health Savings Accounts, we understand that High Deductible Health Plans are NOT for everyone. We have the tools to run an analysis on your current health insurance options, balance the costs with what you tell us is important, and provide a recommendation on the best option for your family. Give us a call if you have any questions during this open enrollment, we will be happy to help.